2024-2025: A Critical Window for Retirement and Estate Planning

The College’s retirement and tax planning experts explain why 2024 and 2025 tax decisions are critical for your clients.

Subscribe to Newsletter

Related Posts

FinServe Network Convenes for 2025 Summit

View DetailsMay 07, 2024

As the provisions of the SECURE 2.0 Act take effect, the retirement planning landscape is undergoing major changes. In this new environment, the IRA, tax, and trust planning strategies that worked in the past are no longer viable. To help clients maximize their estates and minimize their tax bills, financial professionals need to start thinking about retirement tax planning in bold new ways.

When the closing bell rang at the end of 2023, surging stock market values left retirement accounts bulging. But supersized IRA balances are not necessarily good news.

In a recent webcast The American College of Financial Services held exclusively on its subscription-based learning platform Knowledge Hub+, IRA expert and professor of practice Ed Slott, CPA explained that a sizable IRA is little more than a ticking tax time bomb primed to explode in years to come. That’s because through the required minimum distributions (RMDs) mechanism, IRAs create a stream of taxable income – and the bigger the IRA, the bigger the income stream and its associated tax bill.

“In 2023, we had the highest end-of-year stock values of all time. Prepare your clients for larger RMDs and keep in mind that these may get taxed more heavily in the future,” Slott said. “A large IRA balance is just tax waiting to happen. I always tell consumers: your IRA is an IOU to the IRS.”

“A large IRA balance is just tax waiting to happen. I always tell consumers: your IRA is an IOU to the IRS.”

–Ed Slott, CPA

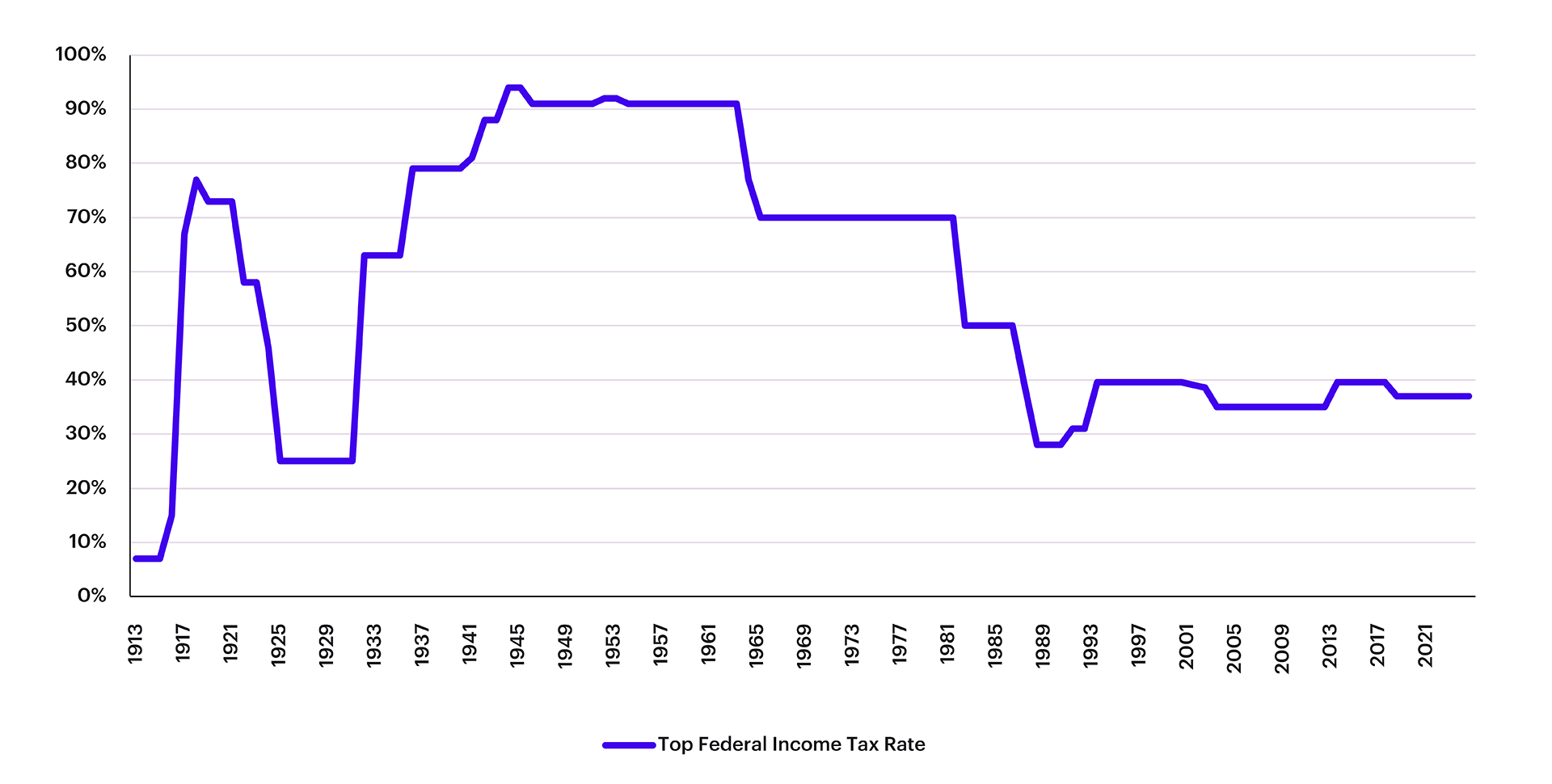

The 2017 Tax Cuts and Jobs Act (TCJA) cut tax rates to historic lows (see Figure 1); however, these favorable rates are scheduled to expire on December 31, 2025, and Slott argued that – against the backdrop of rapidly rising government debt – we’ll likely see rising tax rates soon. That means individuals taking RMDs can expect rising tax bills, and for those with bulging IRA balances, the tax bite could be particularly painful.

Figure 1: Top Federal Income Tax Rates: A Century Snapshot

Further complicating matters, SECURE Act provisions requiring heirs to empty inherited IRAs over 10 years mean those inheriting today’s large accounts may face onerous annual tax liabilities post-2025. This is especially true for heirs who may be in their highest earning years as they’re required to empty their inherited IRAs.

“In the aftermath of the SECURE Act, IRAs are a horrible wealth transfer and estate planning vehicle,” Slott said. “The whole balance of the inherited IRA is going to be taxed in a shorter window and heirs may only have two years left at today's favorable tax rates.”

“In the aftermath of the SECURE Act, IRAs are a horrible wealth transfer and estate planning vehicle.”

–Ed Slott, CPA

IRAs: A Poor Vehicle for Estate Planning

With tax rates poised to rise, tax-deferred vehicles like IRAs are looking increasingly unattractive, particularly for clients who wish to use their retirement savings accounts to benefit their heirs. Advisors must urgently find new ways to structure estates that deliver larger inheritances with lower taxes.

Fortunately, Slott had some good news for those seeking to implement fresh strategies.

Due to the combined impacts of the TCJA and inflation, 2024 and 2025 offer clients a unique opportunity to pay lower taxes as they restructure their estates. Not only are tax rates low by historical standards, but rising inflation has also inflated tax brackets. This means clients can pay lower rates on larger amounts of income (see Figure 2).

Figure 2: 2024 Tax Rates: Joint vs Single Filing

Marginal Tax Rates |

Married Filing Jointly |

Single |

|---|---|---|

10% |

$0–$23,200 |

$0–$11,600 |

12% |

$23,201–$94,300 |

$11,601–$47,150 |

22% |

$94,301–$201,050 |

$47,151–$100,525 |

24% |

$201,051–$383,900 |

$100,526–$191,950 |

32% |

$383,901–$487,450 |

$191,951–$243,725 |

35% |

$487,451–$731,200 |

$243,726–$609,350 |

37% |

Over $731,200 |

Over $609,350 |

Knowledge Hub+. Ed Slott’s Top Retirement Tax Planning Opportunities for 2024. April 2024.

“Look how much income can come out at 22%, or 24%,” Slott said. “Hundreds of thousands of dollars of taxable income can be withdrawn at these unbelievably low rates, and this is only going to go on for two more years.”

“Hundreds of thousands of dollars of taxable income can be withdrawn at these unbelievably low rates, and this is only going to go on for two more years.”

–Ed Slott, CPA

All of this makes 2024-2025 an opportune time to explore the possibility of restructuring your clients’ estates by migrating assets from tax-deferred vehicles like IRAs to tax-free vehicles such as Roth IRAs or life insurance products.

The idea, Slott says, is to pursue an aggressive, proactive IRA withdrawal strategy focused on reducing the balances held in tax deferred accounts and migrating assets to tax-free options. Instead of simply taking the RMD, clients would withdraw greater amounts and convert the proceeds into Roth IRAs, life insurance, or other vehicles depending on their needs.

Slott acknowledged clients may balk at the idea of taking large distributions and paying the associated tax bills; however, he also pointed out balances held in IRAs are inevitably going to be taxed – the only question is when and at what rate. By choosing to take bigger distributions and pay tax now, when tax rates are low and tax brackets are generous, clients can protect themselves against future tax increases. And by transferring assets to instruments like Roth IRAs or life insurance, clients can create wealth transfer vehicles that enable them to pass on larger inheritances tax-free.

Slott warned that this strategy isn’t necessarily right for every client; charitably inclined clients, for example, may find it preferable to use their IRAs as a vehicle for charitable giving either through qualified charitable distributions (QCDs) or charitable remainder trusts (CRTs). Very high net worth clients, on the other hand, may wish to avail themselves of today’s generous gifting allowances to transfer assets to heirs before their passing.

Advisors should also consider the specific circumstances of each client – clients who may need funds in the short term might not be suitable candidates for a Roth conversion, for example.

“The retirement savings tax rules are the most complex in all the tax code,” said Slott. “They affect almost every client you have. And the laws are not only complex, but they are also unforgiving. We've seen mistakes that have cost clients a fortune and cost advisors their clients. Don't let it happen to you. Be proactive. Learn what your clients need you to know to help them protect and preserve their retirement savings.”

“Retirement savings tax rules are complex and unforgiving. We’ve seen mistakes that have cost clients a fortune and cost advisors their clients. Don’t let it happen to you.”–Ed Slott, CPA

When it comes to retirement tax planning, there are many twists and turns. Want to learn more? Enroll now in Ed Slott & Company's IRA Success, an e-learning experience that helps financial professionals understand the complexities of IRA distribution planning and qualifies for up to 27.5 CE credit hours. You can also find content from Ed Slott, CPA on Knowledge Hub+, now available exclusively to members of The College’s Professional Recertification Program – and coming soon to the general public!

Related Posts

FinServe Network Convenes for 2025 Summit

View Details