5 Steps to Handling High Inflation

As high inflation persists, there are simple things you can do to manage its impact.

Subscribe to Newsletter

Related Posts

FinServe Network Convenes for 2025 Summit

View DetailsMarch 02, 2023

By now, you have seen the headlines and felt the pain at the pump or the grocery store – inflation is back, and it is not going anywhere.

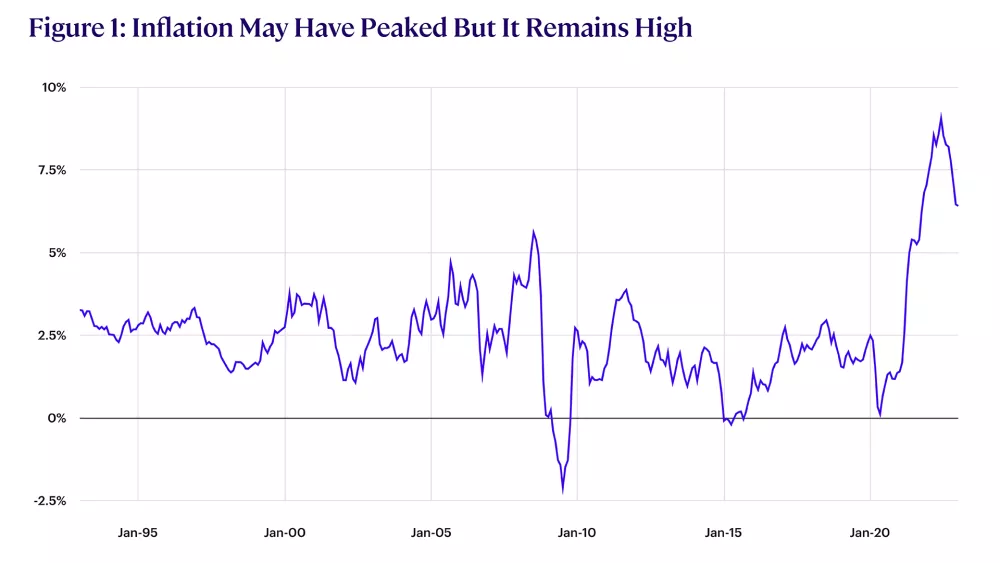

While the pace of inflation has slowed, it remains uncomfortably high (see Figure 1). Consumer prices continue to rise, and persistent inflation is eroding the value of savings and – combined with rising interest rates and struggling markets – hurting investors.

The good news is that there are practical steps you can take to reduce the impact of inflation on your family, budget, and portfolio.

Step 1: Do Not Panic

While inflation can be a source of stress, it is important to maintain perspective. Although prices are high and still rising, most households have a surprisingly robust capacity to adjust to high inflation and there are many things you can do to protect yourselves and your family.

So, do not allow yourself to become overly stressed – instead, focus on what you can do to thrive despite high inflation.

Step 2: Review Your Income

If you are currently employed, consider the impact inflation has had on your income. Has your salary kept pace, or have you accepted a stealth pay cut as inflation eats away at the value of your paycheck?

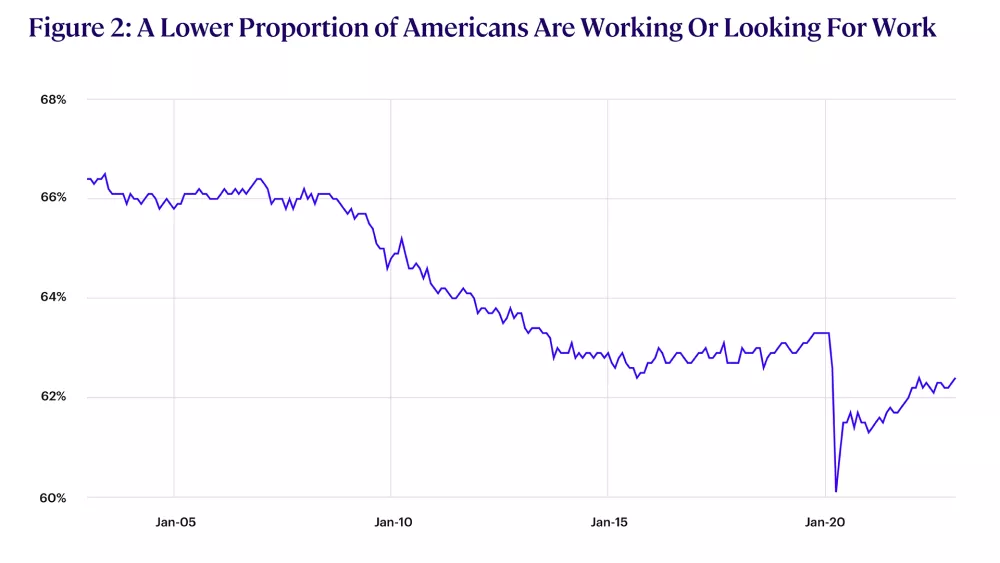

Remember, despite some easing, labor markets remain tight, with the labor force participation rate – which measures the proportion of Americans that are either employed or seeking employment – still well below pre-pandemic levels (see Figure 2). If your income has not kept up with inflation, it may be time to consider a new job.

For those in retirement who are worried about their income, there was some good news on the Social Security front – Social Security checks were increased by 8.7% for 2023 to account for higher inflation.

However, if you are drawing an income from your retirement savings, talk to your financial advisor. You may need to increase your drawdown rates to cover today’s higher cost of living but this may pose a risk to your long-term plans. Your advisor can help you balance your need for higher income against the need for capital preservation.

Step 3: Review Your Expenses

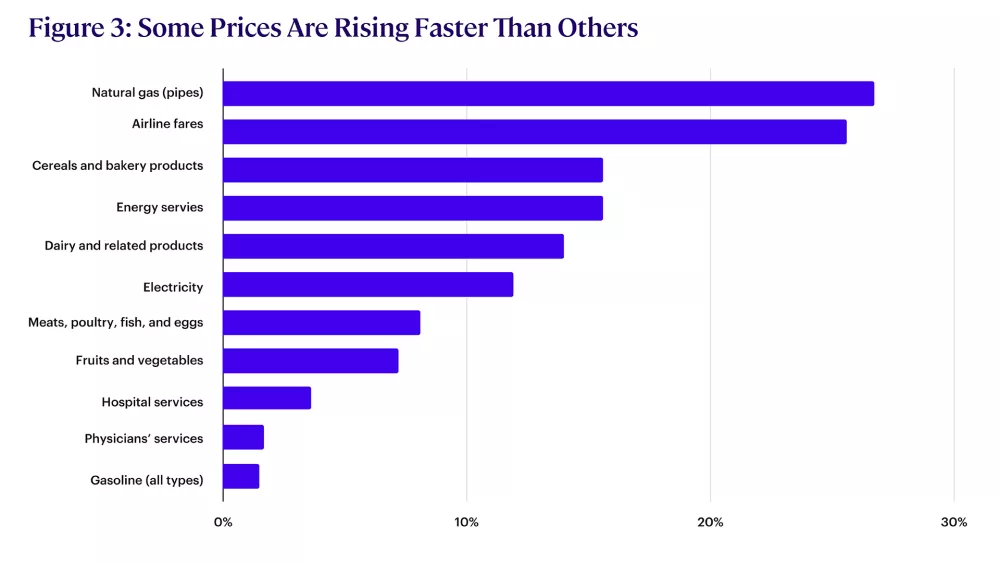

As prices rise, it makes sense to review your spending and budget. Some products and services have seen more significant price spikes than others, so adjusting your activities to reduce your exposure to especially expensive items can improve your personal inflation rate (see Figure 3).

For example, you could plan a vacation within driving distance to avoid high airfares or use an air fryer rather than a gas stove to prepare your meals.

Step 4: Review Your Debt

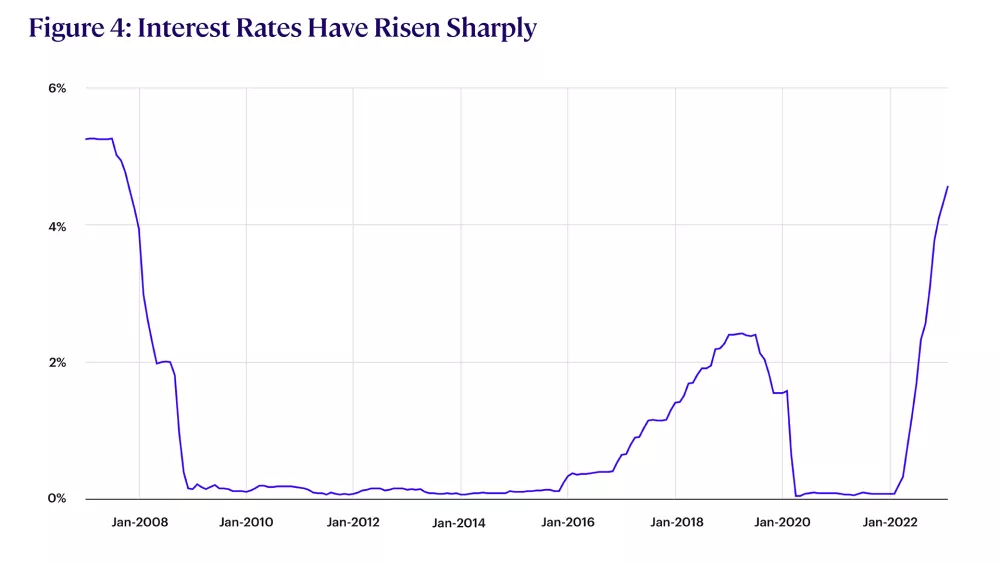

To fight inflation, the US Federal Reserve has been steadily raising interest rates, which are now at their highest level since 2007 (see Figure 4).

As rates rise, payments on variable-rate debt rise, and this could be putting a squeeze on your budget. If possible, therefore, it makes sense to pay down variable-rate debt or to consolidate it into a low-rate or fixed-rate pool.

Step 5: Check Your Portfolio

The key to financial well-being is generating inflation-beating returns. But after the painful contraction in asset prices over the last two years, you may feel that this goal is unachievable.

However, by making sure you have a balanced and diversified portfolio, you can set yourself up for long-term success. Review your portfolio and make sure you include allocations to assets that have traditionally served as a hedge against inflation, such as real estate, Treasury Inflation-Protected Securities (TIPS), or gold. This, combined with risk-appropriate allocations to equities and bonds, will help you outperform inflation in the long term.

More From The College:

Get specialized retirement planning knowledge with our RICP® Program.

Get the details of our WMCP® Program.

Related Posts

FinServe Network Convenes for 2025 Summit

View Details